The Myanmar Investment Commission (MIC) is a government-appointed body under the Ministry of National Planning and Economic Development that appraises Foreign Investment in Myanmar, Local Myanmar Investment and Joint Venture (JV) Investment Proposals of Myanmar and foreign investor.

Forms of investment

-The Myanmar Investment Law sets out three different options for investing in Myanmar.

-100% foreign capital provided by foreigner investors.

-A joint venture with a set foreign and local capital ratio. The ratio may be sector specific and involves negotiations with the foreign investor, local partner, as well as government departments or bodies to create a Joint Venture Agreement

-Various forms of cooperation between the government and private companies in regards to the BOT and BTO schemes, as well as other schemes under a Joint Venture Agreement.

Capital Requirement

-The maximum foreign investment capital ratio shall not be more than eighty percent of the total investment amount if the foreigner has formed joint-venture with the citizen to carry out prohibited or restricted businesses. The Commission may amend the said stipulation by issuing notification from time to time with the approval of the Union Government.

-The minimum capital requirement for foreign companies and JV companies is stipulated by the type of business. For the Service companies, the minimum capital requirement is 50,000 USD and for the other types of companies the minimum capital requirement is 150,000 USD.

-Land use rights

-Investors are entitled to lease or use land for an initial period of 50 years depending on the type of business or industry and the volume of investment. After the expiry of the term of the right to use land or building or the period of right to lease of land or building permitted, a consecutive period of (10) years and a further consecutive period of (10) years extension to such period of lease of land or building may be obtained with the approval of the Commission.

Investment Protection

-The Government of Myanmar guarantees that any business holding an investment permit from MIC shall not be nationalized within the term of the contract or its extended term.

Tax Incentive

-Zone 1 (Less Developed Regions) – 7 Years (Income Tax)

-Zone 2 (Moderate Developed Regions) – 5 Years (Income Tax)

-Zone 3 (Developed Regions) – 3 Years (Income Tax)

-Exemptions or Relief for Custom Duty or other internal taxes

-on machineries, equipments, instruments, machinery components, etc………

Foreign Technician

-Access to stay permits, foreign experts and technicians can be appointed

We provide the MIC Application Service with the 13 Years Experience.

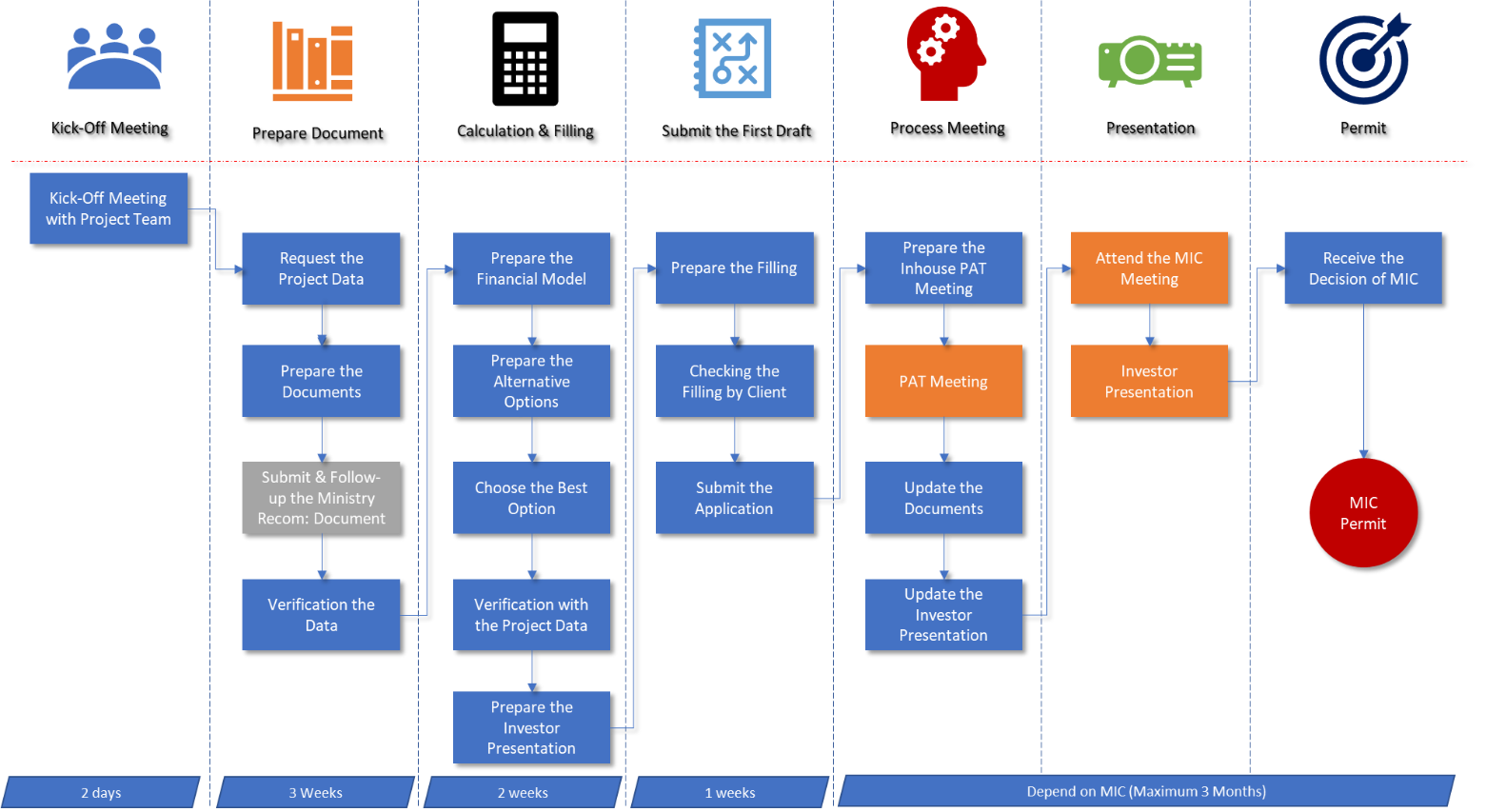

MIC Process